CDFI History

An Industry Where Capital Meets Purpose

Over the past 50 years, community development financial institutions have grown and flourished across the country. From a single proof point in a South Chicago neighborhood to an industry over 1,300 institutions strong, today’s CDFIs have established themselves as a vital part of the community development ecosystem.

Explore the History of CDFIs

The Roots of the CDFI Movement

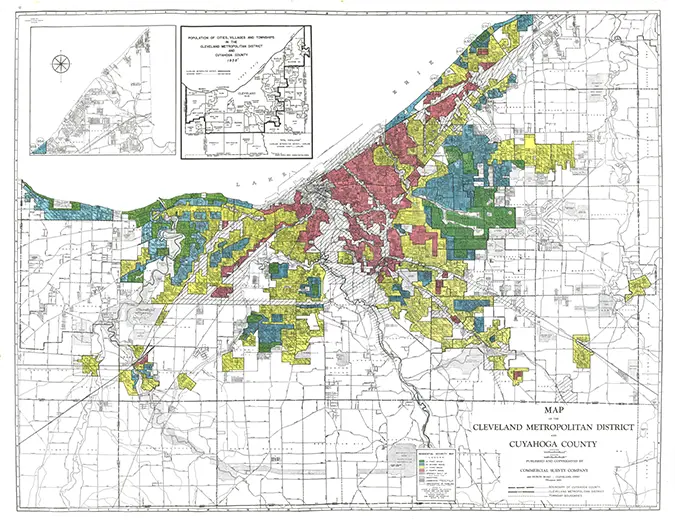

The CDFI story is rooted in the Civil Rights Movement and the War on Poverty. As activists pressed for both equal rights and economic opportunity, federal lawmakers passed a series of fair lending laws, including the Fair Housing Act, Equal Credit Opportunity Act, and the Community Reinvestment Act.

At the same time, communities began creating new models to expand economic opportunity. Community Development Corporations were launched, and in 1973, South Shore Bank (later ShoreBank) opened in the South Side of Chicago. ShoreBank is widely considered the first CDFI, proving that a bank could be both profitable and committed to rebuilding a redlined neighborhood. Alongside ShoreBank, community development credit unions and the first CDFI loan funds began to take root, laying the groundwork for a national movement.

First Wave

By the mid-1980s, dozens of community loan funds had emerged across the country. Many were started by activists and organizers drawing from civil rights, labor, and social justice movements, with early capital coming from individuals and religious orders.

In 1994, the passage of the Riegle Community Development and Regulatory Improvement Act created the CDFI Fund within the U.S. Treasury. The Fund provided equity grants that allowed CDFIs to build balance sheets and leverage private capital, fueling industry growth. At the same time, revisions to the Community Reinvestment Act (CRA) gave banks incentives to invest in CDFIs.

This period also saw the creation and emergence of national intermediaries that expanded the field’s reach, such as Opportunity Finance Network (then the National Association of Community Development Loan Funds).

Second Wave

In the early 2000s, CDFIs solidified into a recognized industry. They pioneered new financing markets—from healthy food access to charter schools to manufactured housing—and became reliable “financial first responders” during the Great Recession, expanding capital access even as mainstream banks pulled back.

Industry infrastructure matured, with the launch of the CDFI assessment and rating system (now Aeris), the creation of new federal programs like the Capital Magnet Fund and Bond Guarantee Program, and large-scale corporate partnerships such as Create Jobs for USA with Starbucks.

In the 2010s and 2020s, CDFIs entered the public capital markets, weathered the COVID-19 pandemic, and gained recognition as trusted community partners and financial institutions. Corporate and philanthropic investors, alongside federal recovery programs, drove unprecedented new resources into the sector.

Third Wave

As CDFIs seek to best serve their communities and clients, they have stepped further into the national spotlight, positioning the industry for a period of growth and expansion.

As the industry enters its third wave of impact, the call for its work has never been more urgent. To scale for deeper impact, CDFIs are strengthening infrastructure, expanding talent pipelines, adopting new technologies, and driving innovation in their products and approaches.

Throughout this evolution, CDFIs have remained rooted in their core purpose: expanding access to capital and opportunity for all. The industry continues to attract people from a wide array of professional backgrounds who are eager to apply their skills to strengthen the communities they care about.

Dive Deeper

Explore our “CDFI 101: History of the CDFI Industry” resource to learn more about the roots and evolution of the industry.